India has achieved its ambitious target of USD400 billion in exports 9 days ahead of the end of this fiscal year. Imports during this period touched USD589 billion, resulting in a trade deficit of USD188.2 billion. However, the exports milestone represents a growth of over 21 per cent in exports compared to the previous record high of USD330 billion achieved in FY2019 before the pandemic set in. This year’s net translates to USD33 billion worth of exports per month, USD1 billion of exports every day and USD46 million worth of exports every hour. Let’s take a quick look into our exports baskets and what worked:

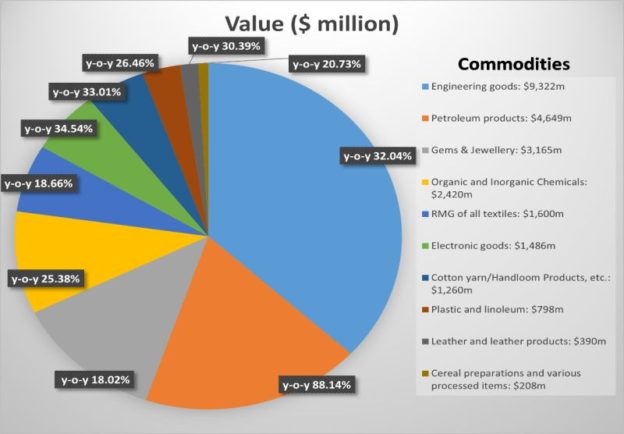

A. Engineering goods: Contributing 26.9 per cent of all merchandise exports in the first 11 months of FY22, this was the largest share of the exports pie.

B. Oil: Processed petroleum exports doubled in the first 10 months of FY22 to USD50.2 billion, up from USD25.3 billion in FY21. This was a result of rising crude oil price, aggravated by the post-pandemic world, demand spiking for oil and, additionally, the recent geopolitical tension. While it was tagged at USD64.8 per barrel at the beginning of the year, the price of Brent crude has now almost doubled to USD115 per barrel.

C. Gems and Jewelry: Exports in this sector rose to an unprecedented USD32 billion, bagging a sizeable share of almost 10 per cent of India’s exports.

D. Industrial items: India saw an earning of foreign exchange worth USD19.2 billion from iron and steel exports in the first 10 months of FY22, up from USD12.1 billion in FY21. The export of organic chemicals totaled USD18 billion in April–January FY22, while plastic exports rose to USD7.5 billion and rubber exports to USD3.7 billion.

E. Agri exports: India’s agriculture and allied exports have grown at a robust 24 per cent in the first 10 months of FY2022.

F. Electronic items and mobile phones: Boosted by government-initiated incentives, exports in these sectors have now reached pre-pandemic levels

A significant takeaway from this development is the diversification of India’s exports basket. This year marked the exports of high-value, finished goods which are higher up the value chain. India is further investing in building infrastructure to fix logistics bottleneck, which will enhance export competitiveness. A combination of policy support, further exploration of trade agreements (such as the latest CEPA with the UAE) and a strategy that constantly identifies emerging markets for exports will help in retaining this exports momentum.

#merchandiseexports #India #exports #manufacturing #emergingmarkets #globalsupplychain

Ministry of Commerce and Industry, Government of India |

https://www.cogoport.com/blogs/indias-top-10-exports-and-who-buys-them