Mumbai: Top officials of LIC have been busy giving presentations to global and frontline domestic investors on how it’s moving ahead to transform into a digital-driven insurer. The presentations have been made with the aid of merchant bankers during initial meetings in the run-up to the insurance giant’s record-breaking IPO planned for next year.

LIC officials have told investors that it has spent about Rs 565 crore since it started investing heavily on digital transformation initiatives three years ago. As a result, from about 26% of its total premium collection being paid through digital channels in FY19, this number is now up at 43% — a jump of 17 percentage points. Its officials also told investors that till March 2021, LIC’s portal had nearly 53 lakh registered users. In FY21, it had registered 95% annual growth in premium paid through its app, they said.

Since markets regulator Sebi bars IPO-bound companies from disclosing future projections, LIC didn’t disclose its annual targets for premium payments through the digital channels. However, sources said the share of premium paid through digital channels in overall premium payment is now near the 50% level already.

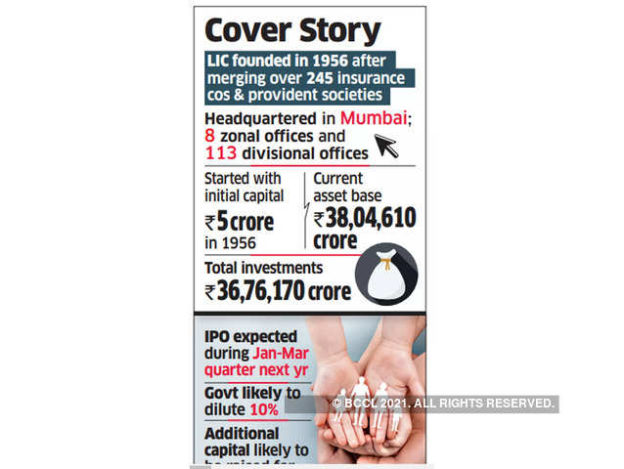

The government-owned life insurance major is currently working to file its IPO prospectus with Sebi and has a timeline to complete the offering by March 2022 — that has been reiterated by several top finance ministry officials as well. At about Rs 1 lakh crore, LIC’s IPO is seen to be the largest in India’s history, much ahead of the Rs 18,300-crore that Paytm mobilised through its offering that closed in November this year.

To fast-track its digital transformation initiative, LIC about 10 days ago came out with a document for consultants to express their interest to work with it to take this process forward. LIC invited “expression of interest (EoI) from bidders who provide strategy consulting services, to develop a strategy road map for digital transformation of LIC of India in line with its business strategy”.

According to the timeline given in the document, LIC would finalise the consultant for this project in about three weeks.

Sources said LIC is in the process of implementing a new and unique customer identification and de-duplication system. This is part of efforts to bolster its digital initiatives and will allow the life insurer to cross-sell its products more efficiently. Further, it is expected to simplify customer experience, allow for customisation of services and make the claims management system more efficient.

The document published by LIC said that its proposed technology strategy will be developed with a host of objectives. These include key technology shifts for the life insurer, technology infrastructure & architecture to support digitisation processes, better integration with partners, front-end & core technology system change, design thinking-led approach, build effective practices, build a world-class analytics capability, an integrated road map and analytics capabilities.

LIC officials have told investors that it has spent about Rs 565 crore since it started investing heavily on digital transformation initiatives three years ago. As a result, from about 26% of its total premium collection being paid through digital channels in FY19, this number is now up at 43% — a jump of 17 percentage points. Its officials also told investors that till March 2021, LIC’s portal had nearly 53 lakh registered users. In FY21, it had registered 95% annual growth in premium paid through its app, they said.

Since markets regulator Sebi bars IPO-bound companies from disclosing future projections, LIC didn’t disclose its annual targets for premium payments through the digital channels. However, sources said the share of premium paid through digital channels in overall premium payment is now near the 50% level already.

The government-owned life insurance major is currently working to file its IPO prospectus with Sebi and has a timeline to complete the offering by March 2022 — that has been reiterated by several top finance ministry officials as well. At about Rs 1 lakh crore, LIC’s IPO is seen to be the largest in India’s history, much ahead of the Rs 18,300-crore that Paytm mobilised through its offering that closed in November this year.

To fast-track its digital transformation initiative, LIC about 10 days ago came out with a document for consultants to express their interest to work with it to take this process forward. LIC invited “expression of interest (EoI) from bidders who provide strategy consulting services, to develop a strategy road map for digital transformation of LIC of India in line with its business strategy”.

According to the timeline given in the document, LIC would finalise the consultant for this project in about three weeks.

Sources said LIC is in the process of implementing a new and unique customer identification and de-duplication system. This is part of efforts to bolster its digital initiatives and will allow the life insurer to cross-sell its products more efficiently. Further, it is expected to simplify customer experience, allow for customisation of services and make the claims management system more efficient.

The document published by LIC said that its proposed technology strategy will be developed with a host of objectives. These include key technology shifts for the life insurer, technology infrastructure & architecture to support digitisation processes, better integration with partners, front-end & core technology system change, design thinking-led approach, build effective practices, build a world-class analytics capability, an integrated road map and analytics capabilities.

Mumbai: Top officials of LIC have been busy giving presentations to global and frontline domestic investors on how it’s moving ahead to transform into a digital-driven insurer. The presentations have been made with the aid of merchant bankers during initial meetings in the run-up to the insurance giant’s record-breaking IPO planned for next year.

LIC officials have told investors that it has spent about Rs 565 crore since it started investing heavily on digital transformation initiatives three years ago. As a result, from about 26% of its total premium collection being paid through digital channels in FY19, this number is now up at 43% — a jump of 17 percentage points. Its officials also told investors that till March 2021, LIC’s portal had nearly 53 lakh registered users. In FY21, it had registered 95% annual growth in premium paid through its app, they said.

Since markets regulator Sebi bars IPO-bound companies from disclosing future projections, LIC didn’t disclose its annual targets for premium payments through the digital channels. However, sources said the share of premium paid through digital channels in overall premium payment is now near the 50% level already.

The government-owned life insurance major is currently working to file its IPO prospectus with Sebi and has a timeline to complete the offering by March 2022 — that has been reiterated by several top finance ministry officials as well. At about Rs 1 lakh crore, LIC’s IPO is seen to be the largest in India’s history, much ahead of the Rs 18,300-crore that Paytm mobilised through its offering that closed in November this year.

To fast-track its digital transformation initiative, LIC about 10 days ago came out with a document for consultants to express their interest to work with it to take this process forward. LIC invited “expression of interest (EoI) from bidders who provide strategy consulting services, to develop a strategy road map for digital transformation of LIC of India in line with its business strategy”.

According to the timeline given in the document, LIC would finalise the consultant for this project in about three weeks.

Sources said LIC is in the process of implementing a new and unique customer identification and de-duplication system. This is part of efforts to bolster its digital initiatives and will allow the life insurer to cross-sell its products more efficiently. Further, it is expected to simplify customer experience, allow for customisation of services and make the claims management system more efficient.

The document published by LIC said that its proposed technology strategy will be developed with a host of objectives. These include key technology shifts for the life insurer, technology infrastructure & architecture to support digitisation processes, better integration with partners, front-end & core technology system change, design thinking-led approach, build effective practices, build a world-class analytics capability, an integrated road map and analytics capabilities.

LIC officials have told investors that it has spent about Rs 565 crore since it started investing heavily on digital transformation initiatives three years ago. As a result, from about 26% of its total premium collection being paid through digital channels in FY19, this number is now up at 43% — a jump of 17 percentage points. Its officials also told investors that till March 2021, LIC’s portal had nearly 53 lakh registered users. In FY21, it had registered 95% annual growth in premium paid through its app, they said.

Since markets regulator Sebi bars IPO-bound companies from disclosing future projections, LIC didn’t disclose its annual targets for premium payments through the digital channels. However, sources said the share of premium paid through digital channels in overall premium payment is now near the 50% level already.

The government-owned life insurance major is currently working to file its IPO prospectus with Sebi and has a timeline to complete the offering by March 2022 — that has been reiterated by several top finance ministry officials as well. At about Rs 1 lakh crore, LIC’s IPO is seen to be the largest in India’s history, much ahead of the Rs 18,300-crore that Paytm mobilised through its offering that closed in November this year.

To fast-track its digital transformation initiative, LIC about 10 days ago came out with a document for consultants to express their interest to work with it to take this process forward. LIC invited “expression of interest (EoI) from bidders who provide strategy consulting services, to develop a strategy road map for digital transformation of LIC of India in line with its business strategy”.

According to the timeline given in the document, LIC would finalise the consultant for this project in about three weeks.

Sources said LIC is in the process of implementing a new and unique customer identification and de-duplication system. This is part of efforts to bolster its digital initiatives and will allow the life insurer to cross-sell its products more efficiently. Further, it is expected to simplify customer experience, allow for customisation of services and make the claims management system more efficient.

The document published by LIC said that its proposed technology strategy will be developed with a host of objectives. These include key technology shifts for the life insurer, technology infrastructure & architecture to support digitisation processes, better integration with partners, front-end & core technology system change, design thinking-led approach, build effective practices, build a world-class analytics capability, an integrated road map and analytics capabilities.

https://cio.economictimes.indiatimes.com/news/corporate-news/lic-flaunts-e-initiatives-for-global-investors/88579643