Govt must lower tariff protections for domestic manufacturers to spur them to become globally competitive

Unless there is a low and stable tariff regime, companies will not be encouraged to think global and invest for the long term.

As this newspaper recently reported, India’s average applied import tariff fell to 15% in 2020 from 17.6% in the previous year. That may not seem like much in absolute terms, but it is the biggest annual fall in a decade. That said, the rate itself is higher than the 13.5% that prevailed in 2014. The country’s trade-weighted average tariff—total customs revenue as percentage of overall import value— eased for a second straight year, to 7% in 2019 from 10.3% in 2018, the lowest level since 2014, as per the latest World Trade Organisation (WTO) data.

While successive governments, over the years, have attempted to bring down duties, in reality, they have been loth to do so; local producers have lobbied hard to keep tariffs elevated in order to protect their businesses. That’s despite a clutch of economists, including former CEA, Arvind Subramanian and former NITI Aayog vice-chairperson Arvind Panagariya, arguing in favour of an open economy that would help boost the country’s export, creating jobs in large numbers. India needs to break out of the import substitution trap before it can become an export powerhouse. After all, one of the objectives of having a strong export base is to be able to import those goods that the country cannot produce efficiently enough, without creating a big trade deficit.

Unfortunately, though this government too prefers to look inwards and stay protectionist. The government is now working on a comprehensive review of the numerous exemptions on customs duties—some 400 of them—and hopes to have a new duty structure by October. The exercise is important, given the many anomalies. However, in the past, revenue considerations have almost always overwhelmed the need to have a duty structure that is free of distortions. Also, this government has made no secret of the fact that it wants to promote manufacturing locally; going by the enormous delays in disbursing refunds to exporters, it would appear that boosting exports is almost an afterthought.

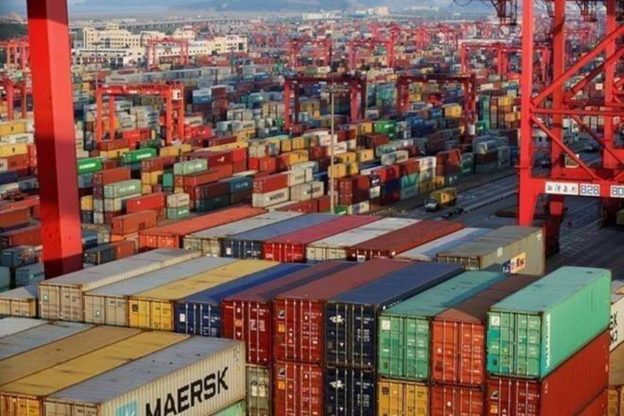

FM Nirmala Sitharaman said in her FY21 Budget speech that the focus of the rejigging exercise needs to be easy access to raw materials and exports of value-added products so as to promote local manufacturing and enable India to become part of the global supply-chain. The point is the country’s manufacturers must want to be part of this supply-chain rather than only wanting to cater for the local markets. Given governments continue to pander to local manufacturers—by keeping import duties elevated—there is little reason for them to aspire to become exporters. A protectionist approach keeps industry from building scale and leaves it globally uncompetitive.

What is needed is a plan to boost exports—not necessarily by incentivising them through schemes like MEIS or SEIS which are in conflict with multilateral trade rules—but by ensuring that the tax content in exports is expunged, the infrastructure is top-class and the labour laws are flexible. Moreover, import duties—for components and raw materials—need to be zero or low and stay that way.

This would allow manufacturers to become efficient and compete in the world markets. As Biswajit Dhar, professor, JNU, wrote in these pages, successive governments have remained focused on trade liberalisation but have largely ignored the need to work towards improving the competitiveness of domestic enterprises. Unless there is a low and stable tariff regime, companies will not be encouraged to think global and invest for the long term. And until that happens, India cannot become part of the global supply-chain.

https://www.financialexpress.com/opinion/make-in-india-must-make-for-the-world/2299014/