- Infibeam is betting on its relationship with Mukesh Ambani’s JioMart to get the contract to handle the grocery outlet’s online payment transactions

- Right now, JioMart is the only private company that is using Infibeam’s Government e-Marketplace (GeM) platform.

- In an interview with Business Insider, Infibeam president of corporate finance — R Srikanth — explains how the company plans to meet its target of $100 billion in transactions over the next three to five years.

- Scoring JioMart’s payments transaction business is one of the pillars the fintech firm is banking on to get there.

The Ahmedabad-based fintech company, Infibeam Avenues, is looking to expand its relationship with Mukesh Ambani’s JioMart and ride that wave to $100 billion in transactions over the next three to five years.

Infibeam, which started out as an ecommerce company around the same time as Flipkart, is also looking to improve its operating margins as a percentage of its revenue from 61% to 65%. That’s a jump of 400 basis points (bps) in the amount of profit it plans to generate from its earnings.

“We’ve seen a 60% growth, and considering that the same trend will continue, we will surpass $100 billion.”

Infibeam actually started out around the same time as Flipkart, in 2007, as an ecommerce platform. While Flipkart chose to go into the customer facing business, Infibeam decided to dive into digital payments between businesses.

Right now, there are two main ways that the company makes money— payments and platforms. And, payment transactions are where Infibeam earns most of its revenue.

Whenever a transaction occurs on one of its platforms — whether that’s CCAvenue, Bill Avenue or its flagship ResAvenue platform for the hospitality sector— Infibeam makes a cut. How much that share will be, depends on the value of the transaction. This means, the more money it processes, the more money it’s making.

For this reason, JioMart, with its wide network of merchants and over 2.3 million active customers — according to a December 2020 JPMorgan report — is an opportunity that’s just around the corner.

In an interview with Business Insider India, the president of corporate finance at Infibeam, R Srikanth, explains why the company has set its eyes on the $100 billion prize and how it plans to get there.

Here’s how Infibeam plans to grow manifold in the next 3-5 years

| Segment | Payments | Government e- Marketplace | Neo Banking | Acquirer Processor (CPGS) | New umbrella entity (NUE) |

| Rationale | Acquire payments processing for JioMart and expand in the international market | Expand business with Jio and GoI | Expand secured lending, bring in unsecured lending | Replicate success from Oman in India | Already applied for licence to create NUE with Reliance using the So Hum Bharat Digital Payments |

| Partner | HDFC Bank, JP Morgan Chase Bank and others | Jio Platforms, the Government of India | Bank Muscat and Bank Dhofar | Reliance Industries | |

| Goal | $100 billion | Not disclosed | $200 million | Not disclosed | Not disclosed |

Mukesh Ambani and Infibeam are already friends

The two companies already have a relationship with JioMart being the first private company to use Infibeam’s Government e-Marketplace (GeM) — an enterprise ecommerce software-as-a-service (SaaS) platform that was only available to the Indian government before Ambani.

GeM crossed a cumulative transaction payments value of $13.5 billion in the last week of March 2021 and, according to Infibeam, the government plans to double that in the ongoing financial year.

In October last year, Reliance Jio entered into an agreement with Infibeam Avenues to use its platform for JioMart. Not only is Jio running its systems and services on Infibeam’s platform, the maintenance and upkeep also fall with the fintech company.

But, for Infibeam, GeM is only a stepping stone. It’s is looking to capture JioMart’s payment gateway business to fuel its already growing transaction values even further.

The fundamental point is that we’ve entered JioMart and the objective is that we would like to do the payments processing for JioMart.

Here are edited excerpts from the conversation:

You’ve set a target for $100 billion in the next three to five years. What makes you confident of achieving that goal?

Right now, the good thing is that the government e-marketplace (GeM) is tracking around ₹1 lakh crore. Payments business is also in excess of ₹1.2 lakh crore .

This is despite the fact that some sectors aren’t fully open like aviation, travel, rail bookings, hotel bookings. These sectors haven’t been fully opened, which is a major constraint as of now. That is our high margin-centric sector. The moment that gets opened, then you will have different results in terms of value of transactions.

Highest volume right now is from the education sector, utilities, bill payments — these are fully opened.

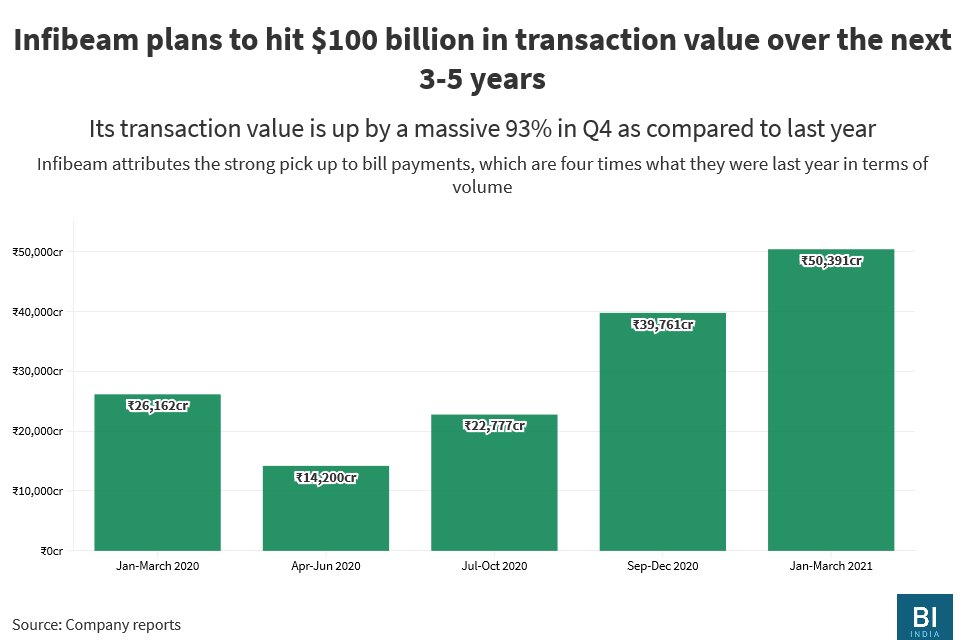

For all practical purposes, we’re at a run rate of $28 billion. On an average, ₹50,000 crore for the quarter, means we can hit above ₹2 lakh crore at an annualised growth rate, which is $28 billion.

That is what gave us the confidence that in a 3-5 years time frame we can touch upon $100 billion in terms of transaction value purposes.

$100 billion in 3-5 years is not such a big task given that the digital push is going to be there. Because, our current digital market is around 15-16%, and there’s headroom for higher digital push in the system.

We factored all this in, when we guided 65% net revenue margin for FY22 from the current 61% in FY21.

What role does your partnership with Jio play in reaching this target?

The GeM [Government e-Marketplace] platform has only been given to Jio [in the private sector]. And using their customisations and so on, JioMart has now gone live with our platform.

The fundamental point is that we’ve entered JioMart and the objective is that we would like to do the payments processing for JioMart. If that happens, we will have cornered the payments processing business of JioMart using our platform entry. In fact, platform entry only strengthened our relationship with Jio to a large extent.

And, what does this have to do with the new umbrella entity (NUE) you’re trying to set up with Reliance?

NUE is a different animal altogether. We applied for the licence with our subsidiary So Hum [Bharat Digital Payments] along with Reliance, but I think we will only know the outcome by around October or November. That is the timeframe. Beyond that I will not be able to comment.

There is a lot of potential for NUE, the minute we get the licence.

But, until such time that we get the licence, we’ll simply have to keep our fingers crossed.

How much do you see gaining from Reliance’s payment business?

All of this has been factored into our guidance. When we say $100 billion in 3-5 years, that includes payments transactions from main accounts and also from the [sic] Jio’s, existing merchants and so on and so forth.

Obviously, due to confidentiality reasons, the main transaction accounts I will not be able to reveal. But, it is all factored into that figure.

Can you shed a little light on what you’re expecting from the neo banking aspect of your business?

In FY20, we announced neo banking to the public market. Under the neo banking umbrella, lending is an important portfolio and credit card issuance is another portfolio. For credit card issuance we’ve already acquired Cardpay Technologies in March 2020.

They’re a card issuance platform that deals with artificial intelligence (AI).

Today, we’re able to issue a credit card provided there is a corresponding bank and a non-banking financial company (NBFC). We are able to ensure credit cards to corporations in less than 15 minutes on a virtual basis. And, in less than four days depending on the logistics, on a physical basis.

The technology platform and everything is in place, rigged with AI. Now, under regulation, we cannot take the credit extension. So, we have to partner with NBFCs, to take the credit exposure.

Lending is not a science, it’s an art. Therefore, while one side the partner discussions with the NBFC banks are all in progress, they don’t want to limit the options of the neobanking umbrella. Therefore, we started a secured lending framework. Under the secured lending framework, we have done express settlement for our merchants.

We want to take this to $200 million.

Are you planning on investing in any new startups to bring in new technologies and new capabilities?

We were not strong in card issuance. In order to do neo banking and unsecured lending, you need to have a card instance platform on your watch. And we did not have one. So, we acquired Cardpay Technologies and built AI over there, and today, we have the ability to do card issuance.

The same way, global remittances is not our cup of tea. So that is being handled by our investee company, RemitGuru.

Having said that, on the credit algorithm, there could be a possibility. As and when we’re ready for real lending through NBFCs and so on, we’ll actively sync in our credit algorithm on the tech platform and then, at that time, we also actively look for acquiring companies in that space. But, not right now.

What kind of a timeline do you see for this?

For partnership discussion in terms of the road map and also the credit algorithms and the corresponding banking relationships and so on, it will take a few quarters. Not right now.

If you see our growth map, we’re very strong in our conventional payment gateway business. Same way, we’re very strong in the B2B payments business. Now, we have brought about two new business offerings — one is our CPGS [CCAvenue Payment Gateway Service] for banks. And, the second business offering that we’ve instituted is neo banking.

We are settling CPGS, we have to accelerate on express settlement and parallelly, we have to start unsecured lending.

How important is the global market for you?

Our road map for growth includes market expansion. Right now, we’re in UAE, Saudi Arabia and Oman. And we also have a physical presence in the US. Our next cup of tea is building up our overseas business.

Not the European market and UK, but in the US, we’ve already started our operation. Like, on the CPGS and PG [payment gateway] side, we’ve white labeled our solution to JPMC India for their India payments — we would like to replace that success in the US.

The COVID-19 situation has created a little bit of a break on that front. But the US is a low hanging fruit.

And, some of the Asian countries — like Indonesia and the Philippines — they’re all low hanging fruits.

https://www.businessinsider.in/business/corporates/news/backed-by-mukesh-ambani-infibeam-expects-business-to-grow-manifold-to-100-billion-dollars/amp_articleshow/83111869.cms