Market Trends and Emerging Patterns

The emergence of on-premise quantum computing deployments can be traced through two distinct periods (see Figure 1 above), with the initial phase spanning from 2016 to 2022, which was pioneered by industry leaders.

D-Wave Systems initiated this journey by delivering their quantum annealing machines to prestigious institutions including the US Air Force Research Laboratory, NASA, and Lockheed Martin. Though these systems utilized annealing rather than gate-based architecture, they demonstrated the viability of on-premise quantum computing installations. IBM followed with a strategic shift in 2019, establishing their first IBM Quantum System One installation outside North America through a partnership with Fraunhofer Gesellschaft in Germany. IBM further expanded their global presence by partnering with the University of Tokyo to install Japan’s first commercial quantum computer, strengthening the country’s quantum capabilities and research infrastructure. Their collaboration with Cleveland Clinic marked another significant milestone – the first commercial healthcare organization to purchase a quantum system with the explicit goal of accelerating biomedical research and drug discovery, signaling quantum computing’s potential impact in healthcare innovation. This period also saw IonQ announcing their roadmap for rack-mountable systems, culminating in the recent installation of their IonQ Forte Enterprise system at Quantum Basel in Switzerland. Rigetti contributed to this momentum by leading a consortium to launch the UK’s first commercial quantum computer, while IQM distinguished itself by establishing on-premise quantum computing as their core commercial strategy from inception.

The landscape transformed significantly from 2022 onwards, marked by the emergence of public funding as a primary market driver. The EuroHPC JU initiative epitomizes this shift, orchestrating a coordinated deployment of quantum computers across six European supercomputing centers in Germany, France, Spain, Italy, Czech Republic, and Poland. This transition from purely commercial arrangements to public-funded programs has fundamentally altered the market structure, with government and research institution funding now driving approximately 30% of new deployments.

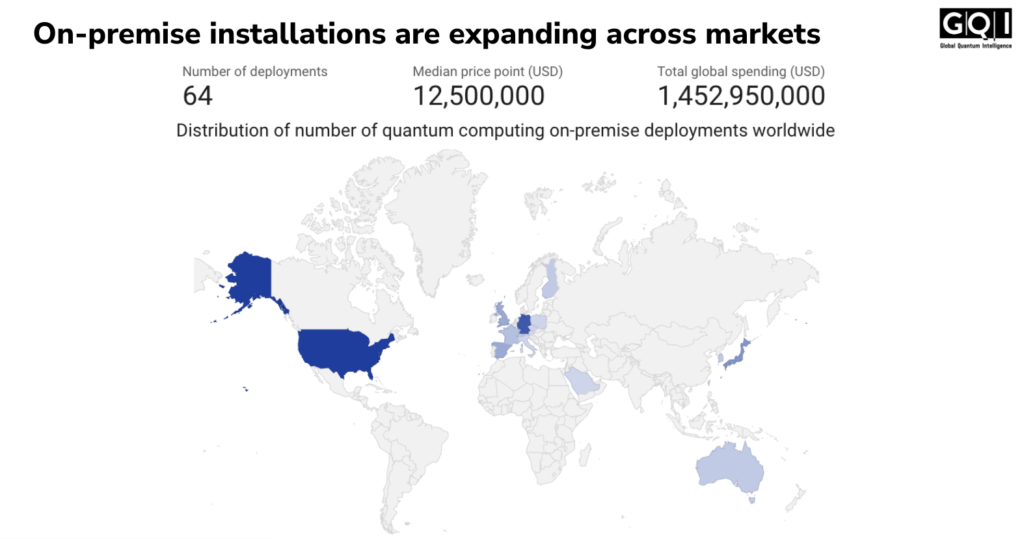

The financial dimensions (Figure 2) of these installations reveal the market’s breadth, with system prices ranging from $500K for basic QPU configurations to $500M for comprehensive facility installations, centering around a median price point of $12.5M USD. This pricing structure reflects both the technological sophistication and the substantial infrastructure requirements of on-premise quantum computing.

The geographical distribution (Figure 2) of the number of deployments shows European leadership, followed closely by the United States. Japan is maintaining a strong presence through established programs, while Taiwan and South Korea are now entering the market with their own quantum computing initiatives. The broader Asia-Pacific momentum continues with Australia’s increasing activity, and similar movements are observed in the Middle East, collectively signaling a geographical diversification of the market.

Figure 2: Global distribution of quantum computing on-premise deployments as of 2024, with key metrics including total installations (64), median price point ($12.5M USD), and total global spending ($1.45B USD). The map highlights regional adoption patterns, with darker shades indicating higher concentration of deployments across North America, Europe, Asia-Pacific, and other regions.

Sellers and Buyers

Hardware Providers and Their Offerings

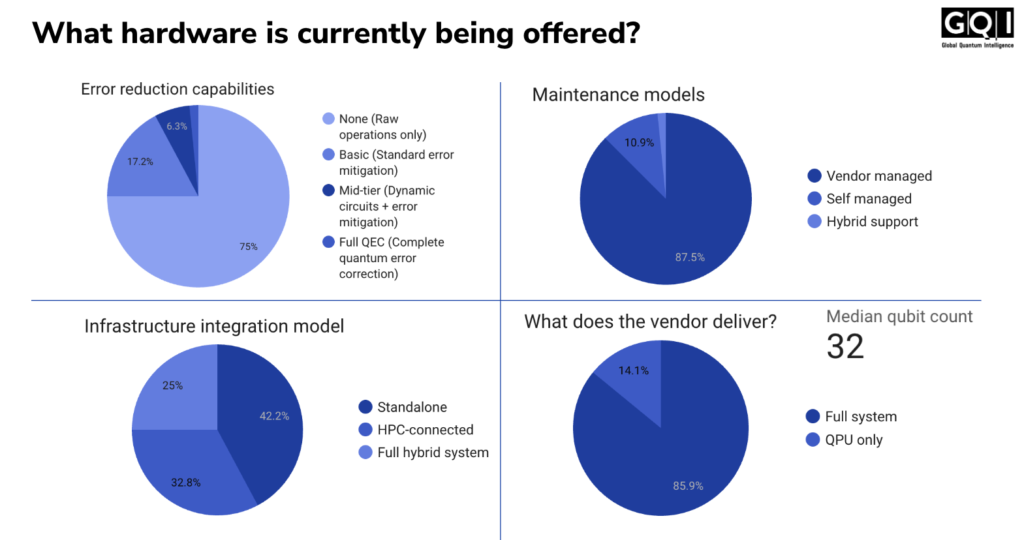

The quantum computing on-premise deployments market encompasses all qubit modality approaches, with superconducting qubit systems representing the largest share of deployments. Current systems (summary of which is presented in Figure 3) operate with limited error reduction capabilities across error suppression, correction, and mitigation functions. The prevalent vendor-dependent maintenance model requires providers to maintain engineering teams for on-site support and manage component supply chains with extended lead times. This arrangement, while operationally complex, provides vendors with significant revenue streams in the pre-quantum advantage period.

Still a big portion of deployments function as standalone systems without integration into high-performance computing environments. Several vendors specialize in quantum processing unit delivery, with auxiliary systems such as control electronics and cryogenic infrastructure available through partner networks or separate procurement channels.

Figure 3: Analysis of current quantum computing hardware offerings across four key dimensions: error reduction capabilities (showing predominance of raw operations), maintenance models (dominated by vendor-managed services), infrastructure integration approaches (distributed across standalone, HPC-connected, and hybrid systems), and delivery scope (primarily full systems). The median qubit count of 32 provides a reference point for system scale.

Buyer Landscape and Market Dynamics

Research and development institutions, including national laboratories and universities, constitute the primary market segment, utilizing quantum computers for fundamental research and algorithm development. Defense and government organizations form a growing segment, typically opting for full purchase arrangements rather than partnership models, driven by operational control requirements.

Commercial organizations in healthcare, pharmaceuticals, financial services, and materials science represent an emerging buyer segment, focusing on specific use cases where quantum computing may provide computational advantages.

The decision to acquire on-premise quantum systems is influenced by data sovereignty requirements, queue time elimination, and the development of internal quantum computing expertise. Research institutions require hardware configuration flexibility, while defense and government organizations prioritize infrastructure control and security considerations.

Long-term Market Perspective

Emerging Market Signals

The recent announcement from Microsoft and Atom Computing about their orders for logical qubit machines raises an intriguing question: Will this herald a new era for on-premise quantum computing, particularly as the industry moves toward error-corrected systems?

Market Challenge

The announcement of IBM’s Heron r2 processor presents a dual impact on the market. While cloud access to such advanced processors may challenge the value proposition of on-premise systems, it could paradoxically accelerate the replacement cycle of existing installations to keep up with computational power of cloud-based machines, potentially driving increased market activity in the near term.

Market Opportunity: Bridging the Valley of Death

The on-premise quantum computing market is emerging as a crucial catalyst for addressing the “valley of death” challenge between research and commercialization across three key domains:

- Hardware components manufacturers are seeing increased demand for specialized equipment – from laser systems and optical components for trapped ion and photonic machines to cryogenic equipment for superconducting processors. These components must operate reliably in unprecedented 24/7 operational environments.

- Control systems providers are developing more sophisticated electronics and measurement devices to meet the demands of continuous operation and system integration.

- Software companies are finding new opportunities in resource management, system integration, and hybrid quantum-classical computing solutions. This includes tools for job scheduling, resource allocation, and performance optimization in operational environments.

This ecosystem-wide validation in real operational conditions is accelerating the maturation of quantum computing technology across the entire value chain.

https://quantumcomputingreport.com/not-new-now-booming-on-premise-quantum-computing/amp/