NVIDIA Corp (NASDAQ:NVDA, ETR:NVD) results are among the most hotly anticipated events on the financial calendar and its upcoming third-quarter earnings are no different.

Supersized, multi-billion-dollar revenue beats are almost a given at this stage of Nvidia’s supercycle.

So much so, that failing to deliver such a revenue beat could pile short-term pressure on Nvidia’s valuation, like when the stock was slapped for $270 billion in September.

Per Nvidia’s own guidance, the artificial intelligence microchip titan is expected to deliver quarterly revenues of $32.5 billion, which is in the ballpark of an 80% year-on-year increase.

Even with Nvidia’s astronomical growth trajectory in mind, this is a lofty target.

The Street, meanwhile, expects Nvidia to slightly exceed this target, given that the group’s internal guidance has historically proven conservative.

It sets the stage for a high-stakes quarterly financial statement on Wednesday, 20 November, although Nvidia has a killer app up its sleeve.

All’s well that’s Blackwell

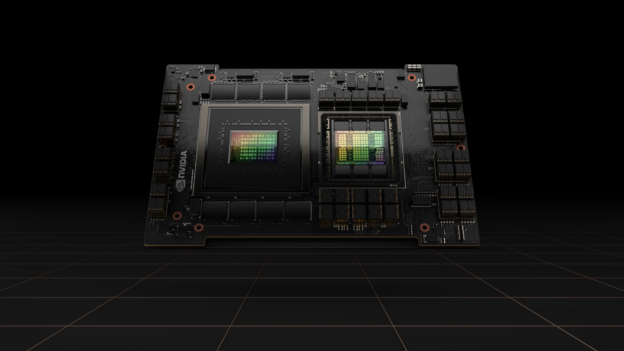

Blackwell, Nvidia’s new flagship AI chip, is in the process of being rolled out to buyers.

The super-powerful processor, named after African American mathematics trailblazer David Blackwell, represents the cutting-edge of AI chip design.

“Any steer as to how well the recently launched ultra-fast Blackwell chip is selling will… be closely scrutinised,” said Derren Nathan, head of equity research at Hargreaves Lansdown.

“There’s no shortage of demand as the likes of Meta, Microsoft, Google, Amazon look to gain an edge in the AI race,” stated Nathan, although he cautioned that “there remain some unanswered questions about NVIDIA’s supply chain’s ability to keep pace”.

Demand is also coming from Japanese multinational SoftBank, which is using Blackwell chips to build Japan’s most advanced AI supercomputer.

The project is in a similar vein to Nvidia’s collaboration with Elon Musk’s xAI, whose Colossus supercomputer cluster comprises 100,000 Nvidia processors.

These and other projects have cemented Nvidia’s status as the world-leading AI company, at least in the hardware space.

But whether sales are sufficient enough to placate investors will be determined next Wednesday.

https://www.proactiveinvestors.com/companies/news/1060744/theralase-technologies-completes-private-placement-to-support-phase-2-bladder-cancer-study-1060744.html