A new generative training model and a batch of new partnerships position Nvidia as one of the driving forces in autonomous driving tech.

As autonomous driving technology heats up, one name is emerging as the frontrunner: Nvidia. The California-based semiconductor giant is rapidly building partnerships and unveiling advanced tech that could give it the edge over competitors.

Tesla may be the name most people associate with self-driving cars, but Nvidia seems poised to challenge that dominance. At CES this week, CEO Jensen Huang announced a slew of new collaborations and tech innovations, including a groundbreaking approach to generative training data. These moves could make Nvidia the go-to company for anyone building autonomous vehicles.

Partnering with industry giants

For years, Nvidia has been a trusted partner for automakers developing self-driving software. At CES, the company doubled down on that role with new deals involving Toyota, Aurora, and Continental. These partnerships showcase Nvidia’s ability to power everything from driver-assistance systems to fully autonomous vehicles.

Take Toyota, for example. The automaker plans to use Nvidia’s DRIVE AGX Orin platform in its next-generation models to dramatically improve features like lane-keeping and adaptive cruise control while laying the groundwork for more advanced autonomy down the line. Then there’s Uber, which announced its partnership with Nvidia to develop self-driving tech using Nvidia’s AI systems and Uber’s massive pool of driving data. It’s a natural pairing that could accelerate the rollout of autonomous ride-hailing vehicles.

Breaking away with generative training data

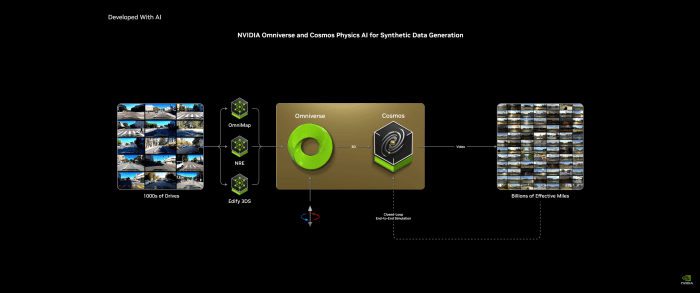

One of Nvidia’s standout innovations this year is its generative physical AI platform, Cosmos. Unlike Tesla, which relies on its fleet of real-world vehicles to gather data for training AI models, Nvidia’s Cosmos can create realistic, physics-based data in a virtual environment. This approach is a game-changer for automakers that don’t have millions of cars on the road collecting data.

Here’s how it works: Cosmos uses a small sample of real-world data to generate massive amounts of synthetic driving scenarios. This simulated data can then be used to train AI systems on tasks like obstacle avoidance or merging into traffic. For companies new to the autonomous driving game, this levels the playing field and allows them to develop competitive systems without waiting years to collect enough real-world driving data.

Nvidia vs. Tesla: different roads to autonomy

Tesla has built its self-driving tech around its own fleet, using data from millions of customer vehicles to refine its AI. It’s a powerful approach, but it has its limits. Tesla’s system relies heavily on cameras and avoids using lidar or radar, which some experts argue makes it less versatile in poor visibility conditions.

Tesla Model Y, equipped with FSD system. Three front facing cameras under windshield near rear view mirror.

Nvidia, by contrast, takes a multi-sensor approach. Its platforms integrate data from cameras, lidar, and radar to create a more comprehensive view of the road. This could make Nvidia-powered systems better at handling tricky scenarios, like driving in heavy rain or dense fog. And while Tesla’s fleet-first strategy locks its tech into its own vehicles, Nvidia’s open platforms can be adopted by any automaker—a key reason so many companies are partnering with them.

A full toolbox for self-driving development

What makes Nvidia’s offering so appealing is the breadth of its ecosystem. The company doesn’t just make chips for in-car computers; it provides tools for every stage of autonomous vehicle development. Automakers can simulate millions of miles of driving in Nvidia’s Omniverse platform, then use the company’s DRIVE AGX Orin units to process real-time data on the road.

This one-stop-shop approach simplifies the process for automakers, who might otherwise have to cobble together solutions from multiple vendors. With Nvidia’s cloud-based training systems, companies can update their AI models remotely, ensuring vehicles stay ahead of the curve as technology evolves.

Synthetic data with real fallbacks

Despite its advantages, Nvidia isn’t without challenges. While generative data is incredibly promising, it still needs validation in the real world to prove its reliability. Tesla’s data, collected from actual driving scenarios, has an inherent credibility that synthetic data doesn’t yet match. Nvidia will need to demonstrate that its virtual training models can produce results that are just as safe and effective as real-world data.

Additionally, the autonomous driving market is fiercely competitive. While Nvidia has made significant inroads, it’s up against established players like Tesla and new entrants with deep pockets and bold ambitions.

What’s next for Nvidia?

Nvidia’s growing list of partners—including Mercedes-Benz, Volvo, and BYD—suggests that the company is well-positioned to dominate the autonomous driving market. The fact that even Chinese automakers like BYD, who have become increasingly independent in their vehicle development, still use Nvidia’s tech is a testament to the company’s reach. Analysts estimate Nvidia’s automotive business could hit $5 billion in revenue by 2026, driven by increasing adoption of its platforms across the industry.

Final thoughts

For now, the battle for autonomous driving supremacy is shaping up to be a two-horse race between Tesla and Nvidia. Tesla’s head start in data collection and brand recognition makes it a formidable competitor. However, Nvidia’s scalable, sensor-agnostic approach could make it the preferred choice for automakers looking to get autonomous vehicles on the road quickly and effectively.

Whether Nvidia can maintain its momentum remains to be seen but with its innovative tech and growing influence, the company is setting the pace for the future of self-driving cars.

https://www.autoblog.com/news/nvidia-is-taking-over-the-autonomous-driving-market