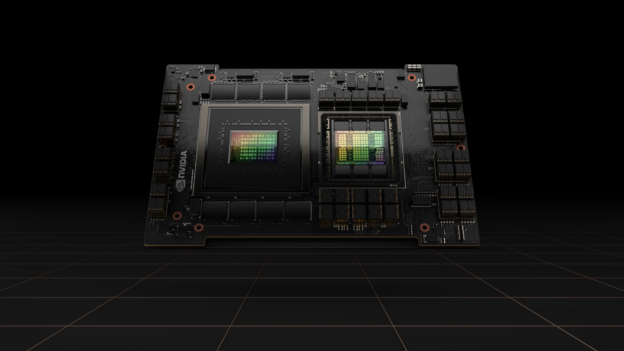

TrendForce reports that NVIDIA has recently rebranded all its Blackwell Ultra products to the B300 series. Looking ahead to 2025, NVIDIA plans to strategically promote the B300 and GB300 lines—which utilize CoWoS-L technology—thereby boosting the demand for advanced packaging solutions.

Under this new branding, the B200 Ultra has been renamed to the B300, while the GB200 Ultra is now referred to as the GB300. Additionally, the B200A Ultra and GB200A Ultra have been updated to B300A and GB300A, respectively. The B300 series is anticipated to launch between the second and third quarters of 2025, with the B200 and GB200 expected to begin shipping from the fourth quarter of 2024 to the first quarter of 2025.

TrendForce highlights that NVIDIA is refining its Blackwell chip segmentation to better meet the performance demands of CSPs and the cost-performance needs of server OEMs, allowing for flexibility based on supply chain capabilities. The B300A is specifically aimed at OEM clients, with mass production projected to commence in the second quarter of 2025 following peak shipments of the H200.

NVIDIA originally intended to launch the B200A series for server OEMs but shifted to the B300A during the design process, indicating a weaker demand for downgraded GPUs than anticipated. Furthermore, the transition from GB200A to GB300A for rack solutions may lead to increased initial costs for enterprise clients, which could hinder growth potential.

Examining NVIDIA’s latest product strategy reveals a clear pivot toward AI models that promise greater revenue in 2025. The company is making significant investments in improving NVL rack solutions, assisting server system providers with performance optimization and liquid cooling for NVL72 systems. Companies like AWS and Meta are being urged to transition from NVL36 to NVL72.

Shipment trends highlight that NVIDIA’s high-end GPU offerings are projected to expand, with an overall shipment share anticipated to hit around 50% in 2024. This marks an increase of over 20 percentage points compared to the previous year. The Blackwell platform is expected to further elevate this figure to 65% in 2025.

TrendForce has also pointed out that NVIDIA plays a crucial role in driving demand for CoWoS technology. As the Blackwell series gains traction in 2024, CoWoS demand is forecast to rise by more than 10 percentage points year-on-year. In light of recent changes, NVIDIA is likely to concentrate on supplying B300 and GB300 products to major North American CSPs—both leveraging CoWoS-L technology.

B300 series to use HBM3e 12hi

NVIDIA is expecting robust demand for CoWoS, and its HBM procurement is on the rise. Projections for 2025 indicate that NVIDIA will account for over 70% of the global HBM market, marking an increase of more than 10 percentage points annually.

TrendForce posits that all models in the B300 series are set to feature HBM3e 12hi, with production slated to commence between the fourth quarter of 2024 and the first quarter of 2025. However, since this will be NVIDIA’s inaugural mass production of a 12hi stack product, suppliers are expected to need at least two quarters to refine their processes and stabilize production yields.

For more information on reports and market data from TrendForce’s Department of Semiconductor Research, please click here, or email the Sales Department at SR_MI@trendforce.com

For additional insights from TrendForce analysts on the latest tech industry news, trends, and forecasts, please visit https://www.trendforce.com/news/

https://www.trendforce.com/presscenter/news/20241022-12335.html