Improved market sentiments, widespread vaccine coverage, and lifting of lockdown restrictions helped this revival.

Real estate PE investments registered an increase of 28% in Q1 FY23 as compared to Q1 FY22, according to ANAROCK Capital’s latest FLUX report. Improved market sentiments, widespread vaccine coverage, and lifting of lockdown restrictions helped this revival.

Commenting in the same, Shobhit Agarwal, MD & CEO – ANAROCK Capital, said, “The revival primarily rode on the top 5 private equity deals, which accounted for 90% of the total value of PE investments in Q1 FY23. There has been a 53% increase in average ticket size in Q1 FY23 when compared to Q1 FY22. Equity contribution to the total PE investments in Indian real estate increased to 87% in Q1 FY23 from 84% in Q1 FY22.”

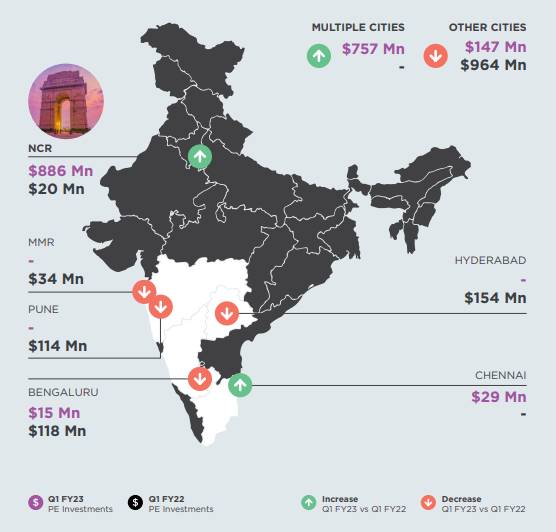

Unlike Q1 FY22, deal activity in Q1 FY23 shifted back to multi-city deals, from the previous focus on single-city deals. NCR has gained significant attention from PE investors, with the highest city-wise inflow at 48% in Q1 FY23 – a huge increase from 1% in Q1 FY22.

Asset Class-wise Funding

In Q1 FY23, deployments by JV platforms into in the commercial real estate sector have increased significantly at 74%, especially in Grade A office spaces which are drawing very high investor interest.

The Industrial & Logistics sector is also showing increased potential, with the creation of a new JV platform between Ivanhoe Cambridge, Bain Capital & Macrotech Developers for an investment of USD 1 Bn.

Domestic vs Foreign Funding

Foreign PE investors displayed increased confidence, with their contribution increasing to 89% in Q1 FY23 from 83% in Q1 FY22.

https://www.financialexpress.com/money/pe-investments-in-real-estate-rise-28-in-q1-fy23-anarock-capital/2606551/