SoftBank Group is tripling the size of its Vision Fund 2, the company’s second giant venture-capital portfolio, to $30 billion from $10 billion, according to Navneet Govil, chief financial officer of SoftBank Investment Advisers.

The news comes in connection with SoftBank’s announcement of strong results for the fiscal year ended March 31. SoftBank (ticker: SFTBY) posted investment gains for the year of $69 billion, which includes gains of nearly $42 billion in the Vision Fund and $4.5 billion in Vision Fund 2. The two funds had gains of $32.8 billion in the March quarter alone, by far the best quarterly result since SoftBank started the original Vision Fund in 2016.

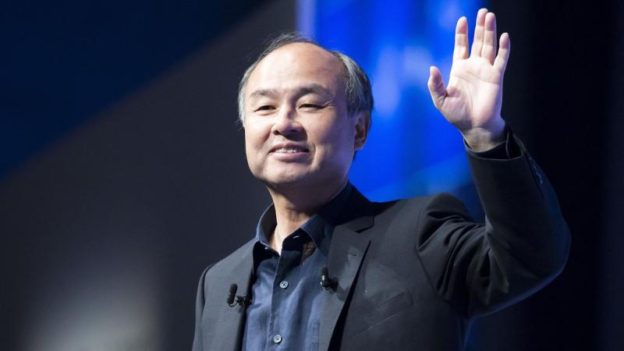

SoftBank faced substantial skepticism when it launched the Vision Fund. Critics thought the fund was simply too large to generate strong returns—and some early stumbles, including the failed initial public offering for the short-term real estate leasing firm WeWork—provided evidence to the SoftBank bears. But a series of recent profitable IPOs for holdings in the fund—and the prospect of additional large IPOs in the months ahead—suggest that the strategy SoftBank founder Masayoshi Son originally laid out is working as planned.

In a presentation deck on the Vision Funds March-quarter results, Govil shows that the two funds together have a combined fair value of $154 billion, with cumulative investment gains of $62.1 billion, and another $22.2 billion in distributions to date.

Govil noted in an interview with Barron’s that Vision Fund 1 has had $57.1 billion in cumulative investment gains on $85.7 billion of investment capital. The fund had total capital commitments of $98.6 billion and maintains some cash for potential follow-on rounds, though it isn’t doing new investments. SoftBank calculates the fair value of Vision Fund 1 at $142.8 billion as of March 31.

Vision Fund 2 has $5 billion of cumulative gains, with a fair value at March 31 of $11.2 billion. The fund has invested $6.2 billion to date. All of the capital in Vision Fund 2 is provided by parent SoftBank Group.

Govil notes that 17 companies from the two funds have gone public to date—and he sees further significant additional exits from the Vision Fund in the months ahead. He notes that the Southeast Asian taxi company Grab has agreed to go public via a special-purpose-acquisition-company merger, and there have been reports that Full Truck Alliance, a China-based trucking company, is nearing an IPO filing. He also sees an IPO ahead for the China-based ride-sharing company Didi Chuxing, which has reportedly hired bankers for an IPO; the fund has a $12 billion investment in Didi. And he sees a potentially huge IPO coming for ByteDance, the parent of TikTok.

Navneet is also responsible for the three SPACs that SoftBank Investment Advisers have launched to date—SVF Investment (SVFA), SVF Investment 2 (SVFB), and SVF Investment 3 (SVFC)—none of which have announced merger partners to date. He says the goal is simply to find companies that are IPO-ready, with substantial revenue growth and strong market share that are profitable or with a clear path to get there. He said the target companies could come from one of the Vision Funds or from outside.

As noted earlier, SoftBank founder Son in his remarks on the financial results noted he had some regrets about the performance of the funds, among other things pointing to “a lack of systemic approach” in the funds’ investments.

Govil notes that SoftBank has modified its approach with the second fund, with a more-diversified portfolio and smaller checks than the original fund. He says that investments in the first fund were largely made by leaders without defined sectors—but that the investment team now has 26 investment teams with dedicated areas of focus. Govil adds that with the revolution in artificial intelligence taking place, there are more companies that fit the AI focus of the original Vision Fund.

Asked about the progress on the proposed sale of the chip-design firm Arm Holdings to Nvidia (NVDA), Govil noted that the company had originally cautioned that approvals could take 18 to 24 months, and he says SoftBank is “hopeful” that the transaction will close. But he also says that Arm is showing strong revenue growth and improved profitability, and that the company will consider an IPO or other options if the deal can’t be completed.

On the possibility that WeWork will go public via a SPAC merger, he notes that the Vision Fund has written down most of its investment, and that the expected valuation is well above the fund’s current carrying cost for its WeWork stake, providing potential upside.

He also confirms that the fund wrote down its entire stake in the insolvent financial-services firm Greensill Capital in the March quarter, but declined to specify the size of the write-down.

One other interesting note is that SoftBank over time has actually increased its exposure to the returns on the Vision Fund. As originally structured, the fund raised $98.6 billion, including $40 billion of preferred shares with a guaranteed 7% coupon, of which $35.2 billion has been drawn down. The outside investors in the fund split their investments between common and preferred shares. To date, SoftBank has repaid $14 billion of the preferred shares, effectively increasing SoftBank’s stake in the fund to about 50%.

https://www-barrons-com.cdn.ampproject.org/c/s/www.barrons.com/amp/articles/softbank-boosts-size-of-vision-fund-2-to-30-billion-51620848432