OpenAI gets new $1.5 billion investment from SoftBank, allowing employees to sell shares in a tender offer

- OpenAI is allowing employees to sell about $1.5 billion worth of shares in a new tender offer to SoftBank, CNBC has learned.

- SoftBank’s latest investment adds to OpenAI’s recent $6.6 billion funding round at a $157 billion valuation.

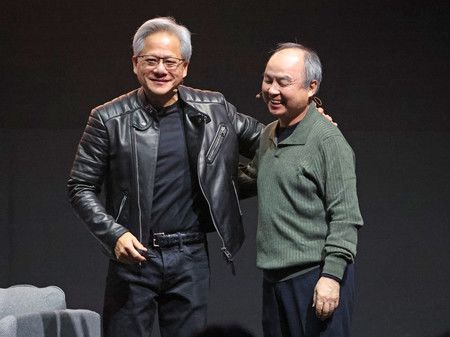

- The deal was spurred by SoftBank billionaire founder and CEO Masayoshi Son, who was persistent in asking for a larger stake in the company, a person familiar with the matter said.

OpenAI is allowing employees to sell about $1.5 billion worth of shares in a new tender offer to SoftBank, CNBC has learned.

The new financing will allow the Japanese tech conglomerate to get an even larger slice of the AI startup and allow current and former OpenAI employees to cash out their shares, two people familiar with the matter told CNBC.

Employees will have until Dec. 24 to decide if they want to participate in the new tender offer, which has not previously been reported, one of the people said. The deal was spurred by SoftBank billionaire founder and CEO Masayoshi Son, who was persistent in asking for a larger stake in the startup after putting $500 million into OpenAI’s last funding round, one of the people said.

The tender offer is not related to OpenAI’s potential plans to restructure the firm to a for-profit business, one of the people said.

OpenAI and SoftBank declined to comment.

The deal, which the people familiar with the matter said was carried out through SoftBank’s Vision 2 fund, underscores Son’s interest in the AI space and in backing the most valuable private players. SoftBank was an early investor in semiconductor company Arm, and Son said at a conference in October that he’s saving “tens of billions of dollars” to make the “next big move” in artificial intelligence. He previously invested in Apple, Qualcomm and Alibaba.

SoftBank’s Vision Fund 2 recently invested in AI startups Glean, Perplexity and Poolside. SoftBank has about 470 portfolio companies and $160 billion in assets across its two vision funds.

The OpenAI investment matches SoftBank’s eagerness to deploy cash, with a capital-intensive business model, a person close to Son told CNBC.

Even without SoftBank’s deep pockets, OpenAI has had no trouble raising billions in cash. Its valuation has climbed to $157 billion in the two years since it launched ChatGPT. OpenAI has raised about $13 billion from Microsoft, and it closed its latest $6.6 billion round in October, led by Thrive Capital and including participation from chipmaker Nvidia, SoftBank and others.

The company also received a $4 billion revolving line of credit, bringing its total liquidity to more than $10 billion. OpenAI expects about $5 billion in losses on $3.7 billion in revenue this year, CNBC confirmed in September with a person familiar with the situation.

OpenAI employees can cash out

The tender offer will be open to current and former employees who had been granted restricted stock units at least two years ago and have held the shares for at least that long, one of the people said. The unit price of $210 will align with the company’s most recent funding round.

Tender offers have become crucial for tech employees amid a dormant IPO market and skyrocketing company valuations. Private companies rely on such deals to keep employees happy and reduce the pressure to list on public markets. Since OpenAI has no initial public offering immediately on the horizon and a price tag that makes the company prohibitively expensive for would-be acquirers, secondary stock sales are the only way in the near future for shareholders to pocket a portion of their paper wealth.

Databricks is another private company raising money to allow employees to cash out and avoid public markets pressure, CNBC reported Tuesday.

OpenAI took a more restrictive approach to tender offers in the past, with rules allowing the company to determine who gets to participate in stock sales, CNBC reported in June. Current and former OpenAI employees previously told CNBC that there was growing concern about access to liquidity after reports that the company had the power to claw back vested equity.

But the company reversed its policies toward secondary share sales in June, and it now allows current and former employees to participate equally in annual tender offers.

The company expects to allow more of these secondary sales, and it will need to tap private markets again in the future based on demand from investors and the capital-intensive nature of the business, according to a person familiar with the new tender offer.

OpenAI has faced increasing competition from startups such as Anthropic and tech giants such as Google. The generative AI market is predicted to top $1 trillion in revenue within a decade, and business spending on generative AI surged 500% this year, according to recent data from Menlo Ventures.

In October, OpenAI launched a search feature within ChatGPT, its viral chatbot, that positions the high-powered AI startup to better compete with search engines such as Google, Microsoft’s Bing and Perplexity.

https://www.cnbc.com/amp/2024/11/26/openai-gets-1point5-billion-investment-from-softbank-in-tender-offer.html