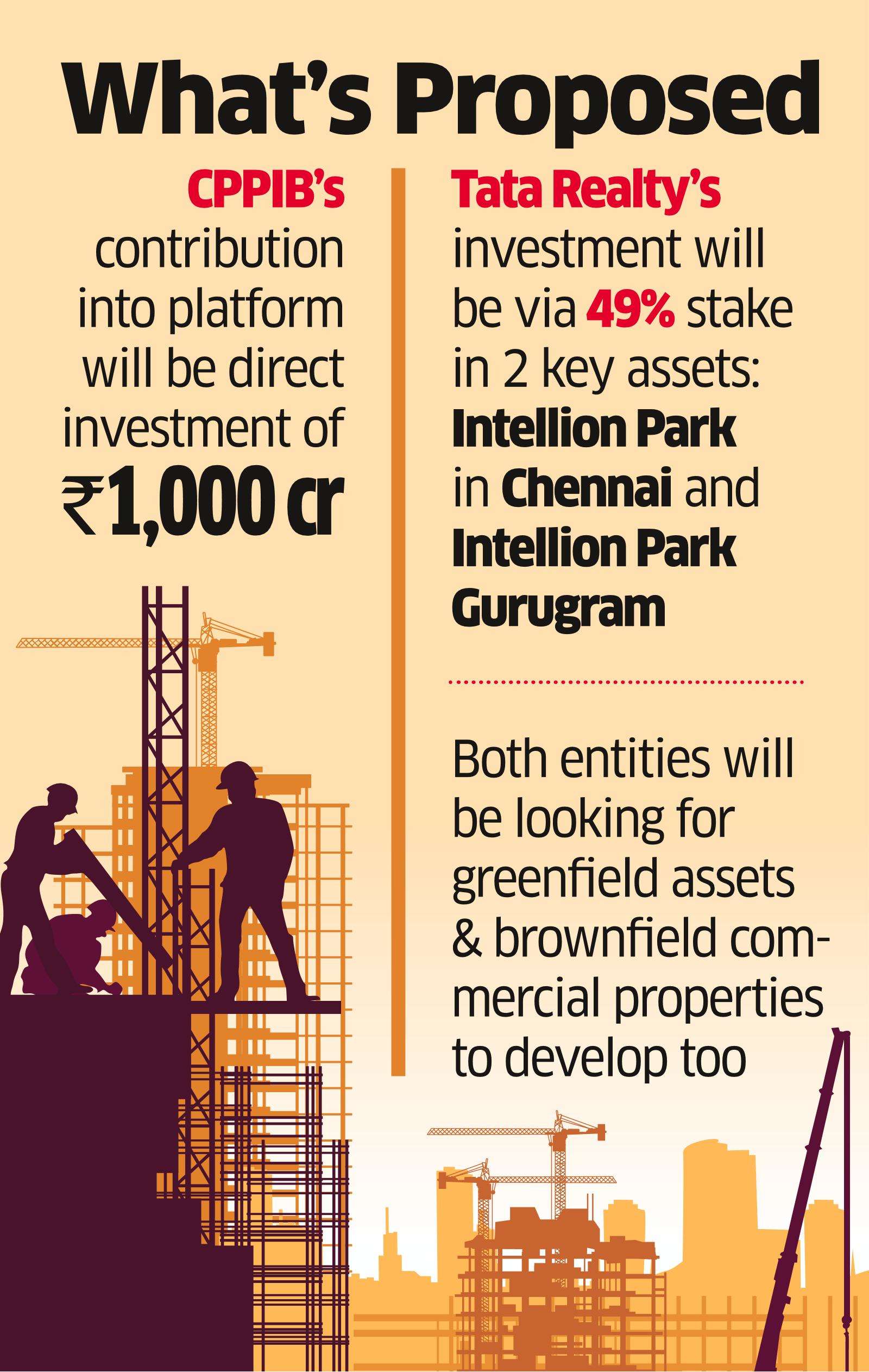

While CPPIB’s contribution will be direct investment of ₹1,000 crore, Tata Realty’s investment will be in the form of 49% stake in two of its marquee information technology special economic zones (SEZ) parks to be offered to the proposed platform, the sources said.

Canada Pension Plan Investment Board (CPPIB) and Tata Realty and Infrastructure are in advanced talks to set up a commercial property development platform in India with a ₹2,000-crore equity base, persons with direct knowledge of the development told ET.

Both CPP Investments, which manages investments for CPPIB, and the Tata Group company are expected to infuse ₹1,000 crore equity each into this joint development company, they said.

“With an equity base of ₹2,000 crore, both entities through this platform will be looking for greenfield assets to beef up the portfolio and brownfield commercial properties across the country to develop them,” one of them said.

While CPPIB’s contribution will be direct investment of ₹1,000 crore, Tata Realty’s investment will be in the form of 49% stake in two of its marquee information technology special economic zones (SEZ) parks to be offered to the proposed platform, the sources said.

The two SEZs are expected to be Intellion Park Chennai, previously known as Ramanujan IT City, and Intellion Park on Golf Course Extension in Gurugram.

The Chennai property is a fully integrated IT city sprawled over a 25.27-acre campus with 4.5 million square feet office spaces across six towers that are completely leased. The Gurugram property is an upcoming IT SEZ with 3.5 million sq ft office spaces across six towers spread over 25.24 acres.

Both CPP Investments and Tata Realty declined to comment.

Their proposed alliance indicates unabated appetite among global institutional investors for office properties in India despite the noise around hybrid and work-from-home models in the backdrop of the ongoing Covid-19 pandemic.

In April, CPP Investments had entered into a joint venture with RMZ Corp to develop and hold commercial office spaces in Chennai and Hyderabad. The Canadian fund will invest ₹1,500 crore into this venture to support development of 10.4 million sq ft of high-quality commercial office sites.

“As India continues to be a strong source of global talent, demand for collaborative and engaging workspace is expected to grow,” Hari Krishna, managing director, real estate – India, at CPP Investments, had said while announcing the alliance with RMZ Corp.

Last month, CPPIB entered into an agreement to extend its commitment to existing alliance with retail mall developer the Phoenix Mills and also to form a new joint venture to develop a 1-million-sq-ft regional retail centre in Kolkata’s Alipore locality.

Both the entities will be collectively investing up to ₹800 crore into their joint venture Island Star Mall Developers.

CPP Investments will also commit to investing around ₹560 crore in Mindstone Mall Developers in tranches, for an ultimate equity stake of 49%.

This commitment also shows the global investor’s interest in Indian mall developments and its confidence in rebounding of retail consumption once the Covid-19 pandemic is over.

ET had reported earlier that the Tata Group has identified property development business as one of its top three focus areas as it looks to become a major player in the country’s burgeoning real estate sector.

https://realty.economictimes.indiatimes.com/news/industry/cppib-tata-realty-in-talks-to-form-rs-2000-crore-property-platform/83737392