Globally, AI startups have raised more than $650 billion in venture capital in the last decade. But how has the industry grown and changed over time?

For this graphic, we partnered with Fasken to explore the change in AI venture capital deal and exit values, along with how these changes have impacted potential investor returns.

Global Changes in AI Venture Capital

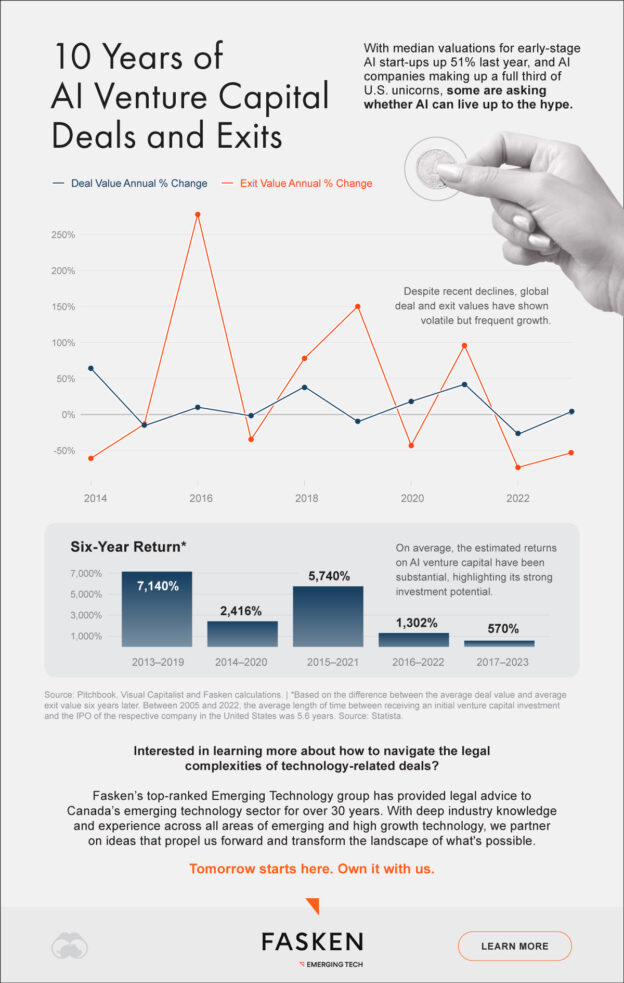

According to data from Pitchbook, average deal and exit values for AI venture capital grew significantly from 2013 to 2021.

But over the last couple of years, average deal values decreased followed by a slight uptick in 2023. Average exit values have also been dropping.

| Year | Avg Deal Value | Deal % Change | Avg Exit Value | Exit % Change |

|---|---|---|---|---|

| 2013 | $4.8M | N/A | $92.9M | N/A |

| 2014 | $7.8M | 64.0% | $36.4M | -60.8% |

| 2015 | $6.6M | -15.6% | $31.5M | -13.4% |

| 2016 | $7.3M | 10.1% | $119.0M | 278.2% |

| 2017 | $7.2M | -1.8% | $77.8M | -34.7% |

| 2018 | $9.9M | 38.6% | $138.4M | 77.9% |

| 2019 | $8.9M | -10.0% | $346.4M | 150.3% |

| 2020 | $10.6M | 18.3% | $197.4M | -43.0% |

| 2021 | $15.0M | 42.1% | $386.7M | 95.9% |

| 2022 | $10.9M | -27.3% | $102.3M | -73.6% |

| 2023 | $11.4M | 4.2% | $48.0M | -53.1% |

Despite recent declines, the sector’s frequent growth up to 2021 highlights its investment appeal and capacity for strong returns.

AI’s Investment Potential

In order to estimate AI venture capital returns, we assumed a six-year holding period. This is based on the fact that, in the U.S., the average length of time between an initial venture capital investment and an IPO is nearly six years. The average duration of a business cycle is also six years, meaning that this holding period would typically capture a full market cycle.

| Holding Period | Six-Year Return |

|---|---|

| 2013–2019 | 7,140% |

| 2014–2020 | 2,416% |

| 2015–2021 | 5,740% |

| 2016–2022 | 1,302% |

| 2017–2023 | 570% |

The difference between average deal values and average exit values six years later—our assumed holding period—have been volatile but substantial. Returns have been on a short-term decline since the period ending in 2021.

The recent drop means that AI venture capital firms will likely be more selective about which companies they back. In other words, firms may be looking for more high-quality investments versus a large quantity of deals. This could mean placing more focus on AI startups that have understandable technology, clear use cases, scalability, and a monetization strategy.

By being adaptable, firms can continue to find opportunities despite volatility in the sector. In the first half of 2024, AI investments drove over 60% of the growth in U.S. venture-backed company valuations.

Advice on Emerging Technology Deals

Interested in learning more about how to navigate the legal complexities of technology-related deals?

Fasken’s top-ranked Emerging Technology group has provided legal advice to Canada’s emerging technology sector for over 30 years. With deep industry knowledge and experience across all areas of emerging and high growth technology, we partner on ideas that propel us forward and transform the landscape of what’s possible.

https://www.visualcapitalist.com/sp/fsk01-ten-years-of-ai-venture-capital-deals-and-exits/