Every new tech revolution emerges in three distinct profit waves, and AI stocks will follow the same pattern

- Every new technological paradigm shift – like the one we’re seeing with AI – follows a similar pattern.

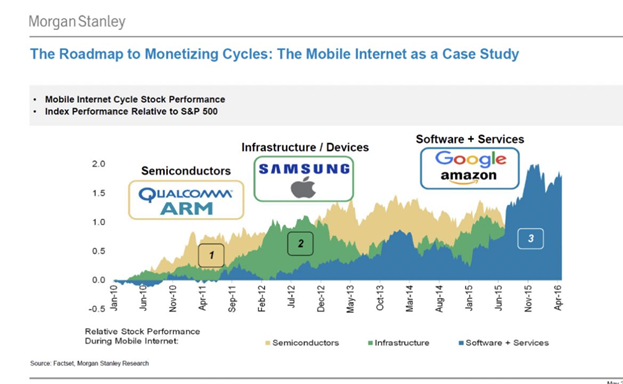

- The best way to play the internet boom of the 2010s was to buy semiconductor stocks in 2010, sell them in 2011, roll the profits into infrastructure stocks, sell those in 2013, then roll those profits into software and services stocks.

- Follow this playbook, and you could mint fortunes in the AI Revolution of the 2020s.

Source: shutterstock.com/Allies Interactive

Editor’s note: “The ‘Millionaire Playbook’ for Easy Profits in the AI Boom” was previously published in June 2023. It has since been updated to include the most relevant information available.

At this point, it’s quickly becoming clear that AI is the real deal. And over the next few years, as it continues its ascent and transforms the world in profound ways, investors that buy AI stocks today will make fortunes.

But one major question still remains…

What are the best AI stocks to buy today?

Should you chase the rally in red-hot AI chipmaker Nvidia (NVDA)? Or maybe buy the breakout in the AI software company C3.ai (AI)? Or is a hardware play like Tesla (TSLA) the best AI stock to buy right now?

The answer to those questions may be rooted in a historical analysis of previous technological paradigm shifts.

Indeed, every new technological paradigm shift – like the one we’re seeing with AI right now – follows a similar pattern.

They evolve in three distinct “profit waves.”

The ‘Millionaire Playbook’

The first profit wave emerges in the “picks-and-shovels” suppliers of the new tech – the companies that make the stuff that powers the technology.

The second profit wave emerges in the infrastructure makers for the new tech – the companies that take those picks and shovels and make new devices.

And the third profit wave emerges in the software and services developers for the new tech – the companies that create cool, usable applications on top of the new devices.

Makes sense, right?

First, there’s a gold rush for materials to build new tech. Then, there’s a gold rush for new devices that are built with that tech. Then, once everyone has one of those devices, there’s a gold rush for creating applications and services on top of them.

Take the mobile internet boom of the 2010s, for example.

In that time, we saw a profit boom in semiconductor companies like Qualcomm (QCOM), which was selling the chips that powered smartphones.

A few years later, we saw a profit boom in device-making companies like Apple (AAPL), which took those Qualcomm chips and made ultra-popular iPhones.

By 2015, a profit boom emerged in software and services companies like Alphabet (GOOGL) and Amazon (AMZN). Once smartphones were ubiquitous, those companies built really cool mobile internet applications for those devices.

In other words, the best way to play the internet boom of the 2010s was to buy semiconductor stocks in 2010, sell them in 2011, roll the profits into infrastructure stocks, sell those in 2013, then roll those profits into software and services stocks.

That was the “Millionaire Playbook” for the mobile internet boom of the 2010s.

Monetizing the AI Revolution

It is also the “Millionaire Playbook” for every major technological revolution of the past 50 years. Every new tech revolution emerges in three distinct profit waves: Suppliers first, device-makers second, and software developers third.

The AI Revolution will play out no differently.

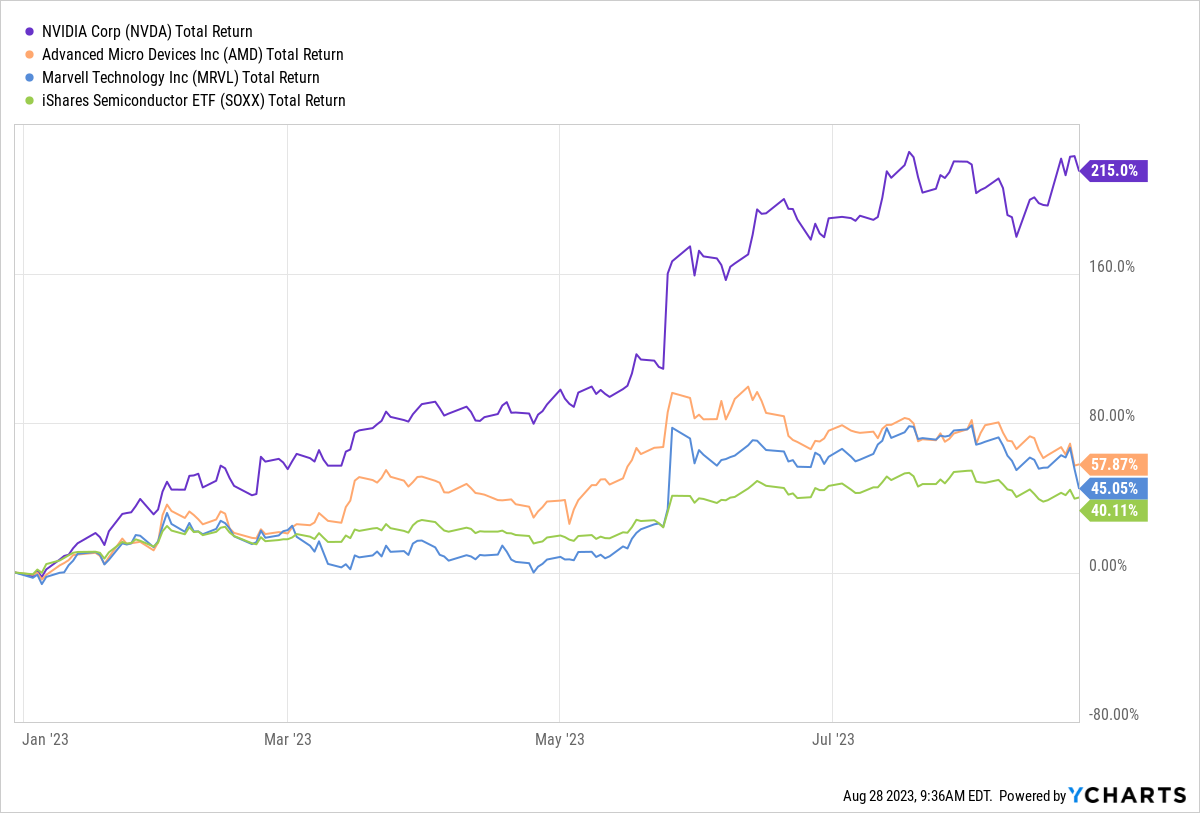

We’re already seeing the first profit wave emerge today. AI chip supplier stocks – paced by Nvidia – are soaring right now.

This boom will last for a year or so. Then, it’ll be the AI hardware makers who experience a profit surge. After that, the AI software developers will start to soar.

https://investorplace.com/hypergrowthinvesting/2023/08/the-playbook-for-profiting-in-the-ai-boom/