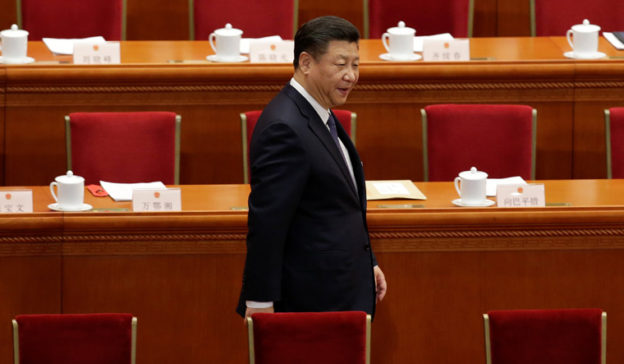

Hong Kong’s future as a global financial hub is less promising after China’s authoritarian action – to control the pandemic and civil liberties – led to an exodus of expatriate finance industry professionals. Can India position Mumbai or Gujarat’s GIFT City as a reliable option for firms and professionals looking for an alternative to Hong Kong?

In the first fortnight of January this year, Indian companies have raised foreign debt of more than $ 6 billion. Interest rates are low, there are good prospects for the rupee to strengthen against the dollar and global funds are keen to invest a portion of their corpus in a strong emerging market like India. The only surprising thing is that so few Indian companies are taking advantage of this opportunity. However, none of the companies raised money at the International Financial Services Center in GIFT City, Gujarat. They went abroad. Can India emerge as a global financial transaction hub, at least for Indian companies? Yes indeed, if only India would first develop a vibrant market for credit for both government and corporates within India.

Is the problem that the rupee lacks full convertibility? Actually, while the rupee is fully convertible for foreign investors, it is only for residents that there are restrictions on automatic convertibility. Therefore, if a foreign investor wishes to participate in the issuance of masala bonds in India (rupee bonds issued to foreign investors that carry exchange rate risk) he can bring in as much capital as he needs, and subsequently it can be withdrawn without any restriction. What of the associated currency, credit and interest rate risks? Can they be completely hedged in India? Alas, no. But Singapore will offer non-deliverable forwards with a longer maturity period than those available on derivatives on offer in India. If some transactions have to be done abroad, why split the issuance process, one part in India and the rest abroad? It will be easy to complete work abroad.

Professionals who transacted for Indian companies, raised debt overseas, in sell-offs as well as trade-in, must have been people of Indian origin for a large part. Suppliers of capital can be located in India just as they are located in New York, London, Singapore or Hong Kong. What will need to be done to shore up the large debt raising activity?

India has done some much-needed spadwork to make the debt market work in India. We have introduced a variety of derivative instruments to hedge against the risks inherent in issuance of debt. However, securities transaction tax remains a hindrance. The regulation now allows netting of payables/receivables. What is still missing is an active secondary market for debt. The RBI must give up its desire to control trade in government debt and to tweak and manipulate short-term and long-term rates through proactive intervention.

Government bonds are securities and should be traded under the special supervision of market regulator SEBI. The government had promised to set up a Credit Guarantee Enhancement Corporation in the 2019 budget. It’s a good idea, a spiritual quality, not an operating entity that provides a useful incentive to kickstart an active bond market.

Indian bond issuances tend to be held rather than traded, that is, held till maturity. Only active trading will help in uncovering the true cost of capital in the Indian market.

Another important step that is necessary is to drop the insistence that only high grade paper will be eligible for investment. Indian companies that raise money through well-rated bonds are also the ones that can raise money anywhere in the world and banks are eager to lend without the cost and hassle of issuing loans. Allowing loan issuance to subprime borrowers will only boost India’s market for corporate loans. To medium enterprises and non-banking financial companies, which lend to the micro, small and medium enterprise (MSME) segment, issue sub-prime bonds that offer interest rates that incorporate a sufficiently high risk premium. Huh. Large savings pools can and do want to invest in such high-yield bonds by allocating a small portion of their total corpus, even those with their high risk profile.

Developing a market for sub-prime bonds is one way to create a vibrant market for debt where Indian companies can raise foreign capital by issuing foreign currency or rupee loans in India.

https://www.livemint.com/opinion/online-views/the-turmoil-in-hong-kong-is-an-opportunity-for-india/amp-11642426288927.html