With UPI in Singapore, the cost of remittances will fall by as much as 10%. Additionally, Indian migrants and tourists will be able to access faster and easier payments.

Starting today, Indians will be able to use UPI to make faster, easier and cheaper payments, and remit money, as the UPI will be linked with Singapore’s payments platform PayNow. This linkage between the digital payment systems will allow users from both the countries to access faster and more cost-efficient cross-border remittances. Tourists and short-term migrants will also be able to use their native UPI applications in Singapore. With UPI in Singapore, the cost of remittances will fall by as much as 10%, Monetary Authority of Singapore’s (MAS) chief fintech officer Sopnendu Mohanty said.

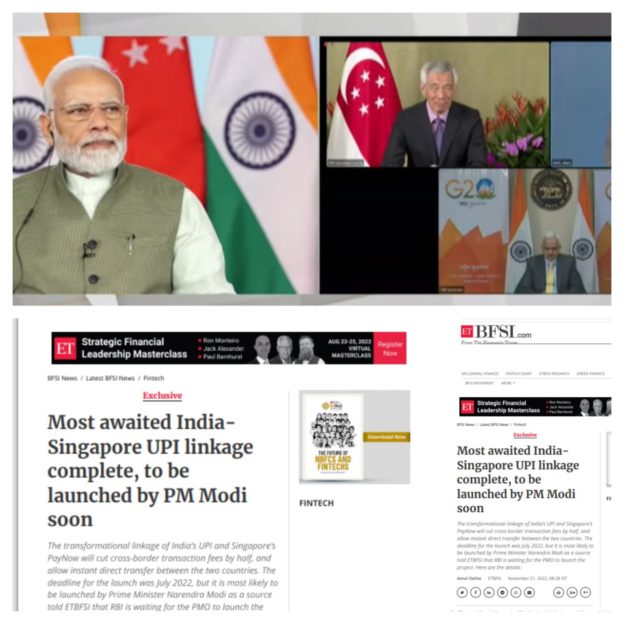

While with PhonePe’s UPI International, Indian users can already make UPI payments in UAE, Bhutan, Nepal and Singapore, where merchants have a local QR code; the linkage with Singapore’s PayNow today will make UPI more universally acceptable across the nation. India Prime Minister Narendra Modi and Singapore Prime Minister Lee Hsien Loong will witness the linking ceremony, as RBI governor Shaktikanta Das and Monetary Authority of Singapore Managing Director Ravi Menon lead the launch of this cross-border connectivity at 11 am on Tuesday.

“As India’s 1st first cross-border real-time payment partner, this milestone initiative reflects the deep trust between both countries and will take the bilateral relationship to even greater heights. We look forward to continue to be part of India’s digital transformation journey,” said Simon Wong, Singapore’s High Commissioner to India. “It will also help the Indian diaspora in Singapore, especially migrant workers and students through instantaneous and low-cost transfer of money from Singapore to India and vice-versa,” said the Prime Minister’s Office in a release.