Visualized: The World’s Largest Sovereign Wealth Funds

Did you know that some of the world’s largest investment funds are owned by national governments?

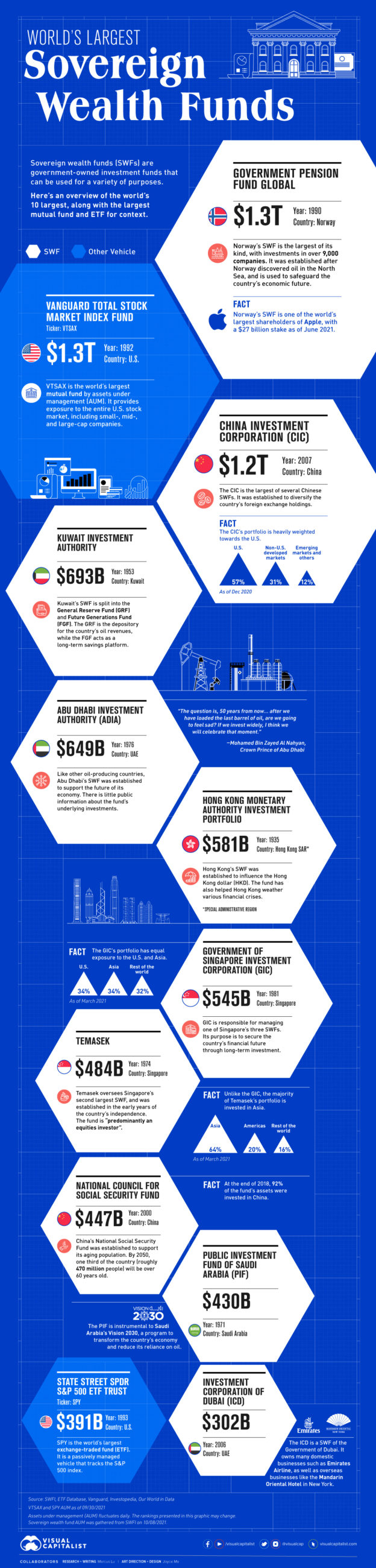

Known as sovereign wealth funds (SWF), these vehicles are often established with seed money that is generated by government-owned industries. If managed responsibly and given a long enough timeframe, an SWF can accumulate an enormous amount of assets.

In this infographic, we’ve detailed the world’s 10 largest SWFs, along with the largest mutual fund and ETF for context.

The Big Picture

Data collected from SWFI in October 2021 ranks Norway’s Government Pension Fund Global (also known as the Norwegian Oil Fund) as the world’s largest SWF.

The world’s 10 largest sovereign wealth funds (with fund size benchmarks) are listed below:

| Country | Fund Name | Fund Type | Assets Under Management (AUM) |

|---|---|---|---|

| 🇳🇴 Norway | Government Pension Fund Global | SWF | $1.3 trillion |

| 🇺🇸 U.S. | Vanguard Total Stock Market Index Fund | Mutual fund | $1.3 trillion |

| 🇨🇳 China | China Investment Corporation | SWF | $1.2 trillion |

| 🇰🇼 Kuwait | Kuwait Investment Authority | SWF | $693 billion |

| 🇦🇪 United Arab Emirates | Abu Dhabi Investment Authority | SWF | $649 billion |

| 🇭🇰 Hong Kong SAR | Hong Kong Monetary Authority Investment Portfolio | SWF | $581 billion |

| 🇸🇬 Singapore | Government of Singapore Investment Corporation | SWF | $545 billion |

| 🇸🇬 Singapore | Temasek | SWF | $484 billion |

| 🇨🇳 China | National Council for Social Security Fund | SWF | $447 billion |

| 🇸🇦 Saudi Arabia | Public Investment Fund of Saudi Arabia | SWF | $430 billion |

| 🇺🇸 U.S. | State Street SPDR S&P 500 ETF Trust | ETF | $391 billion |

| 🇦🇪 United Arab Emirates | Investment Corporation of Dubai | SWF | $302 billion |

SWF AUM gathered on 10/08/2021. VTSAX and SPY AUM as of 09/30/2021.

So far, just two SWFs have surpassed the $1 trillion milestone. To put this in perspective, consider that the world’s largest mutual fund, the Vanguard Total Stock Market Index Fund (VTSAX), is a similar size, investing in U.S. large-, mid-, and small-cap equities.

The Trillion Dollar Club

The world’s two largest sovereign wealth funds have a combined $2.5 trillion in assets. Here’s a closer look at their underlying portfolios.

1. Government Pension Fund Global – $1.3 Trillion (Norway)

Norway’s SWF was established after the country discovered oil in the North Sea. The fund invests the revenue coming from this sector to safeguard the future of the national economy. Here’s a breakdown of its investments.

| Asset Class | % of Total Assets | Country Diversification | Number of Securities |

|---|---|---|---|

| Public Equities | 72.8% | 69 countries | 9,123 companies |

| Fixed income | 24.7% | 45 countries | 1,245 bonds |

| Real estate | 2.5% | 14 countries | 867 properties |

As of 12/31/2020

Real estate may be a small part of the portfolio, but it’s an important component for diversification (real estate is less correlated to the stock market) and generating income. Here are some U.S. office towers that the fund has an ownership stake in.

| Address | Ownership Stake |

|---|---|

| 601 Lexington Avenue, New York, NY | 45.0% |

| 475 Fifth Avenue, New York, NY | 49.9% |

| 33 Arch Street, Boston, MA | 49.9% |

| 100 First Street, San Francisco, CA | 44.0% |

As of 12/31/2020

Overall, the fund has investments in 462 properties in the U.S. for a total value of $14.9 billion.

2. China Investment Corporation (CIC) – $1.2 Trillion (China)

The CIC is the largest of several Chinese SWFs, and was established to diversify the country’s foreign exchange holdings.

Compared to the Norwegian fund, the CIC invests in a greater variety of alternatives. This includes real estate, of course, but also private equity, private credit, and hedge funds.

| Asset Class | % of Total Assets |

|---|---|

| Public equities | 38% |

| Fixed income | 17% |

| Alternative assets | 43% |

| Cash | 2% |

As of 12/31/2020

A primary focus of the CIC has been to increase its exposure to American infrastructure and manufacturing. By the end of 2020, 57% of the fund was invested in the United States.

“According to our estimate, the United States needs at least $8 trillion in infrastructure investments. There’s not sufficient capital from the U.S. government or private sector. It has to rely on foreign investments.”

– DING XUEDONG, CHAIRMAN, CHINA INVESTMENT CORPORATION

This has drawn suspicion from U.S. regulators given the geopolitical tensions between the two countries. For further reading on the topic, consider this 2017 paper by the United States-China Economic and Security Review Commission.

Preparing for a Future Without Oil

Many of the countries associated with these SWFs are known for their robust fossil fuel industries. This includes Middle Eastern nations like Kuwait, Saudi Arabia, and the United Arab Emirates.

Oil has been an incredible source of wealth for these countries, but it’s unlikely to last forever. Some analysts believe that we could even see peak oil demand before 2030—though this doesn’t mean that oil will stop being an important resource.

Regardless, oil-producing countries are looking to hedge their reliance on fossil fuels. Their SWFs play an important role by taking oil revenue and investing it to generate returns and/or bolster other sectors of the economy.

An example of this is Saudi Arabia’s Public Investment Fund (PIF), which supports the country’s Vision 2030 framework by investing in clean energy and other promising sectors.

https://www.visualcapitalist.com/visualizing-the-worlds-largest-sovereign-wealth-funds/